Mayor Shawn Mesheau won’t say explicitly if he backs the plan proposed by Sackville town staff to keep the tax rate flat this year in Sackville.

Other municipalities with significant average property assessment spikes are considering lowering tax rates to help ease tax payments for their residents. Both Saint Andrews and Moncton have discussed reducing their rates, though even with rate reductions, both would still see increases in taxes paid by residents in the neighbourhood of 4-5%. That’s because Moncton and Saint Andrews are both looking at average increases over 10%. The rise in Sackville’s average assessment sits closer to the middle of the pack provincially, at 6.9%.

Treasurer Micheal Beal pointed out in a budget presentation on Monday, that although Sackville is looking at 6.9% increase in its tax base for 2022, the average increase over the past five years is 2.5% per year, due to a drop in values in 2018, and a slow growth year in 2021.

“It’s Council’s decision how they want to see this roll out,” said Mesheau in an interview for Tantramar Report on Tuesday. Mesheau said there were some things he feels the town should be tackling if they decide to keep a flat tax rate.

“One of the things is housing,” says Mesheau. “Housing is a struggle in our community right now. There’s a shortage on rental units… Do we need to maybe take some of the additional revenue that we’re generating this year towards a housing study?”

Mesheau commented on the increase in home sales, without corresponding residential construction.

“So where are those people going?” he asked. “Are they going into different types of accommodations, rentals? Are they moving out of town? Those are all important things that we need to understand.”

Mesheau says the possibility may be discussed at next Monday’s council meeting, along with other ideas. “I’ll be interested to see what other councillors bring to the table,” says Mesheau.

Councillors spent three hours going through the operating and capital budgets for both the town and the water utility on Monday, and are encouraged to submit questions to the treasurer this week, and have them answered at a meeting next Monday, October 25. Click here for a PDF of Monday’s presentation.

Beal’s presentation this past Monday evening covered several areas where the town is expecting increased costs in 2022. Here’s some of the new spending in the town’s proposed operating budget for 2022:

Insurance: approximately $30k

Beal says Sackville’s insurance is set to go up about 10%, which is better than some other municipalities, which he says are dealing with 20-30% increases.

Staffing costs: unknown impact

Cost of salaries and wages will likely go up in 2022, as the collective agreement with town staff ends on December 31, 2021, but Beal won’t say exactly how much the town has budgeted for those to-be-negotiated increases.

In addition to whatever raises get negotiated with CUPE, there are costs for consultants that the town will hire to help with those negotiations.

Fire department uniforms: $34k

Staff is proposing to replace the full dress uniforms of Sackville’s volunteer fire department. The current black uniforms are no longer available at a reasonable price, so a wholesale replacement of all uniforms with blue ones is in order, according to Chief Craig Bowser.

RCMP contract: $115k plus $120k for now

The cost of wages and overtime for the town’s contract with the RCMP will go up 8% for 2022, by $114,785. That 8% is actually less than the overall salary increase announced by the RCMP, which was more in the neighbourhood of 19% cumulative since 2017. Beal says the figures that town is budgeting for come straight from the province, so presumably they are correct. The total cost of the RCMP contract for 2022 is budgeted at $1,536,546.

There is another $120,000 allocated for covering backpay of Sackville RCMP officers for newly negotiated increases that date back to 2017. That total amount is still unknown, but Beal seems to think it will be in the range of $200k.

New sports subsidy: $65k

$65,000 is allotted for the next two years to run a pilot program subsidizing some of the more expensive youth sports offered in town, including hockey, lacrosse, skating and swimming. Instead of subsidizing the programs directly, council chose to give rebates to town residents who registered in the programs, in order to avoid subsidizing people living outside of Sackville taxpayer boundaries.

Active transportation planning: $30k

Active transportation has come up periodically, especially recently when Sackville town council opted to lift the ban on skateboards on town streets. At a public budget meeting on September 20, retired doctor Ross Thomas made a case for increased investment in traffic calming and other active transportation infrastructure. This $30k is allocated for “studies/plans”, so could involve hiring a consultant to help map out the possibilities for active transportation on town streets.

Health care recruitment: $10k

The Rural Health Action Group, part of the Memramcook-Tantramar Community Task Force, is proposing to create a fund to help them with local health care recruitment. Former Sackville mayor John Higham presented to town council on September 20, and made the request for a contribution. It’s not clear exactly what the $10,000 would be used for, but it sounds like the group is hoping to bring in some expertise in creating a recruitment program, and establishing a fund under the Sackville Memorial Hospital Foundation. This $10k wouldn’t necessarily go to recruitment efforts per se, but would seed the program for the future.

Street patching and storm sewer flushing: $20k plus $25k

The price of asphalt patching has been going up, and that’s meant Sackville has been reducing the amount of patching they can do over the years. This year, the town proposes a $20k bump, bringing the budget up to $240,000, to increase the amount of patching that can get done.

A new expense in this year’s budget is storm sewer flushing. Public works has found some storm sewers getting clogged with siltation and other debris, and so they are proposing to introduce a flushing program this year, to be maintained for a few years, says Beal.

Capital out of revenue & capital reserve: $35k plus $17k

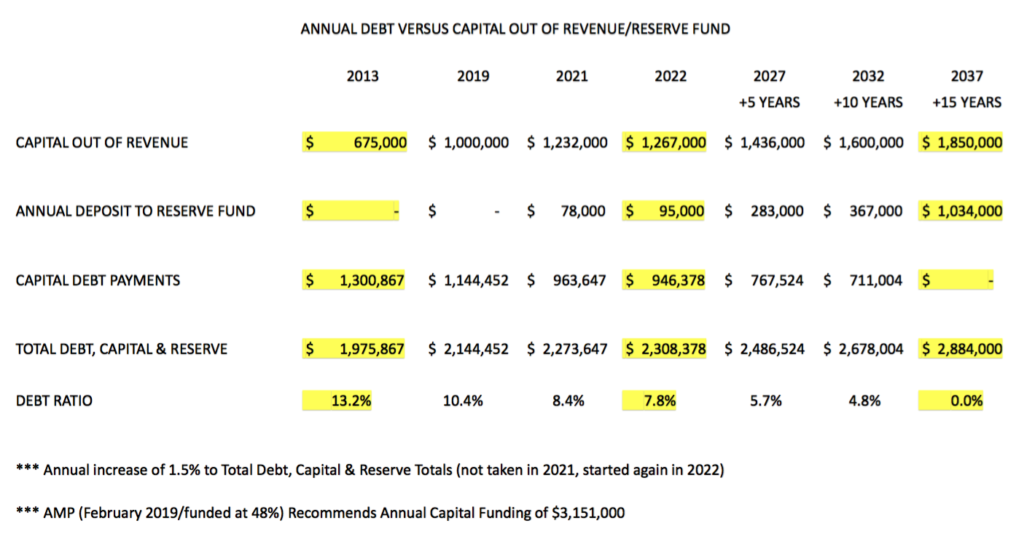

Both of these numbers are proposed to go up in 2022, part of Beal’s long term plan to reduce and eventually eliminate Sackville’s debt.

“Capital out of revenue” is essentially the part of the town’s operating budget that they plan to spend each year on capital projects, like buildings, roads, and other infrastructure. This amount ($1,267,000 for 2022) has been increasing annually for a number of years, making more money available in the capital budget, and reducing the need to borrow.

“Capital reserve” is the town’s long term capital project account, which it can use for major projects. Beal says that with the right planning, Sackville should be able to fund projects every two to three years without stopping debt reduction.

Sackville will pay $946,378 on its capital debt this year, which is down just over $17,000 from last year. By 2027, the town will be have over $1.4 million to spend on building and maintaining infrastructure, according to Beal’s projections. And debt payments will have gone down to about $767,000. By 2037, the debt would be gone, and Sackville would be setting aside $1 million per year for major projects.